QUEENSLAND ART GALLERY ANNUAL REPORT 2007–08

APPENDIXES

88

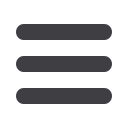

2. Other Revenue

Economic Economic Parent Parent

Entity Entity Entity Entity

2008 2007 2008 2007

$'000 $'000 $'000 $'000

Donations and bequests

7117 1496

300 300

Donations - assets

-

-

2176 2811

Exhibition income and scholarships 1775 295

3819 295

Goods received at below fair value

-

12

-

12

Grants

2082 129

2082

1399

Investment income

697

955

-

-

Interest

619 655

525

653

Unrealised gain on investments at

fair value through profit and loss

-

2186

-

-

Transfer of furniture and fittings

from Arts Queensland

-

7850

-

7850

Other

1366 668

1302 570

Total

13 656 14 246 10 204 13 890

3. Gains

Gains on Sale of Property,

Plant and Equipment

Plant and equipment

12

12

12

12

Total

12

12

12

12

4. Employee Expenses

Employee Benefits

Salaries and wages

10 684 9845 10 684 9845

Employer superannuation

contributions *

1483

1303 1483 1303

Recreation leave expenses

1040 1021 1040 1021

Overtime and allowances

1325 1002 1325 1002

Redundancy payments

300 348

300 348

Long service leave levy *

243 214

243

214

Employee Related Expenses

Payroll and fringe benefits tax *

851 740

851

740

Staff recruitment and training

149

246

149

246

Workers' compensation premium *

50

37

50

37

Other employee related expenses

117

88

117

88

Total

16 242 14 844 16 242 14 844

* Costs of workers' compensation insurance and payroll tax are a consequence

of employing employees, but are not counted in employees' total

remuneration package. They are not employee benefits, but rather

employee related expenses. Employer Superannuation Contributions

and the long service leave levy are regarded as employee benefits.

The number of employees, including both full-time employees and part-time

employees, measured on a full-time equivalent basis is:

Number of Employees

240 194 240 194

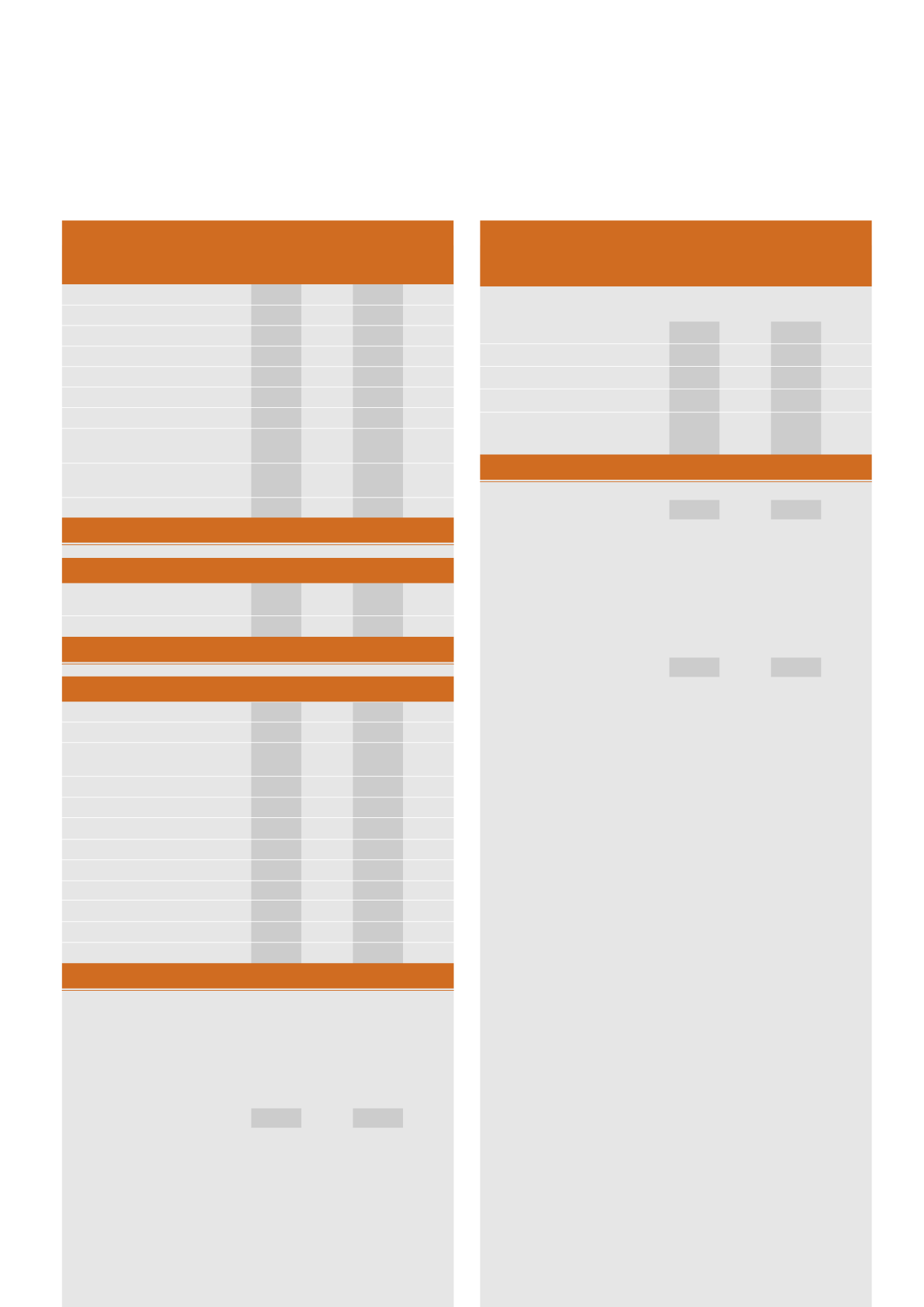

Executive Remuneration

Economic Economic Parent Parent

Entity Entity Entity Entity

2008 2007 2008 2007

$'000 $'000 $'000 $'000

The number of senior executives who received or were due to receive total

remuneration of $100,000 or more:

$120,000 to $139,999

1

-

1

-

$160,000 to $179,999

1

1

1

1

$180,000 to $199,999

-

2

-

2

$200,000 to $219,999

1

-

1

-

$240,000 to $259,999

-

2

-

2

$280,000 to $299,999

1

-

1

-

Total

4

5

4

5

The total remuneration of

executives shown above ** ($'000)

812 1053 812 1053

** The amount calculated as executive remuneration in these financial

statements includes the direct remuneration received, as well as items

not directly received by senior executives, such as the movement in leave

accruals and fringe benefits tax paid on motor vehicles. This amount will

therefore differ from advertised remuneration packages which do not

include the latter items.

The total amount of separation

and redundancy / termination

benefit payments during the year

to executives shown above:

165 319 165 319