QUEENSLAND ART GALLERY ANNUAL REPORT 2007–08

APPENDIXES

94

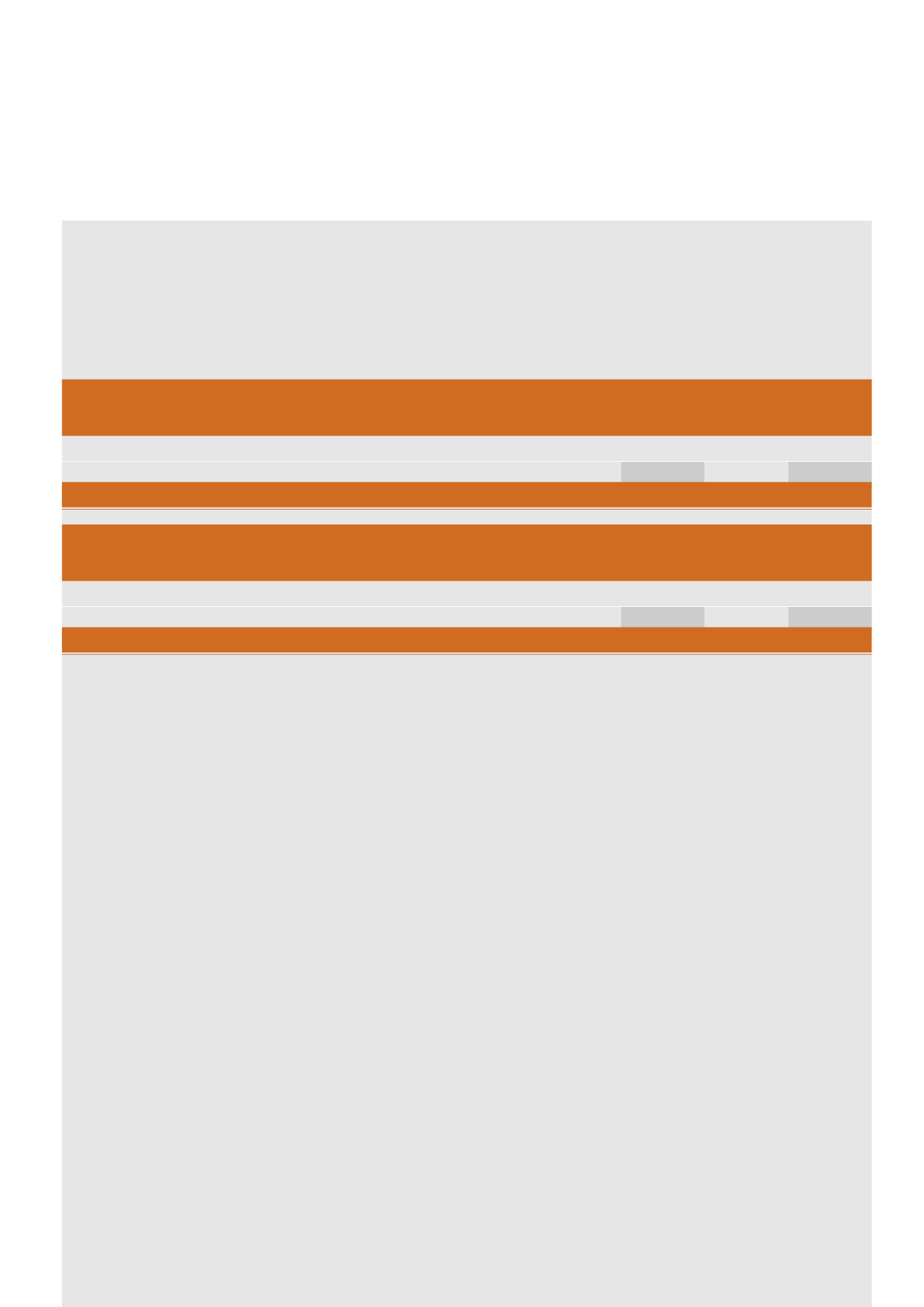

(c) Liquidity Risk

Liquidity risk is the risk that an entity will encounter difficulty in meeting obligations associated with financial liabilities. This risk is controlled through the

Gallery's investment in financial instruments, which under normal market conditions are readily convertible to cash.

The Gallery is exposed to liquidity risk in respect of its payables.

The Gallery also manages exposure to liquidity risk by ensuring that sufficient funds are held to meet supplier obligations as they fall due. This is achieved by

ensuring that minimum levels of cash are held within the various bank accounts so as to match the expected duration of the various supplier liabilities.

The following table sets out the liquidity risk of financial liabilities held by the Gallery. It represents the contractual maturity of financial liabilities, calculated

based on cash flows relating to the repayment of the principal amount outstanding at balance date.

2008 Payable in

Note

< 1 year

1 - 5 years

> 5 years

Total

$'000

$'000

$'000

$'000

Financial Liabilites

Payables

15

1061

-

-

1061

Total

1061

-

-

1061

2007 Payable in

Note

< 1 year

1 - 5 years

> 5 years

Total

$'000

$'000

$'000

$'000

Financial Liabilites

Payables

15

1873

-

-

1873

Total

1873

-

-

1873

(d) Market Risk

Market risk is the risk that changes in market prices, such as foreign exchange rates, interest rates and equity prices will affect the Gallery's income or the value

of its holdings of financial instruments. The Foundation's Investment sub-committee actively monitor investments to ensure overall exposure of the portfolio is

within acceptable levels.

In respect of the managed funds and shares, the Gallery is subject to domestic and international equities market fluctuations. While the Gallery does not trade

in foreign currency, it is indirectly exposed to movements in foreign exchange rates through its funds held in the international market.

The Gallery is exposed to interest rate risk through its cash deposited in interest bearing accounts and managed fund investments. The Gallery does not

undertake any hedging in relation to interest rate risk.