Queensland Art Gallery Board of Trustees Annual Report 2013–14

FINANCIAL STATEMENTS

PART B

32

32

Queensland Ar t Gallery Board of Trustees

Notes to and forming par t of the Financial Statements 2013–14

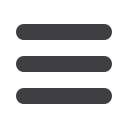

28. Financial Instruments (cont.)

(d) Liquidity Risk (cont.)

The following table sets out the liquidity risk of financial liabilities held by the Gallery. It

represents the contractual maturity of financial liabilities, calculated based on cash flows

relating to the repayment of the principal amount outstanding at balance date.

Maximum exposure to liquidity risk:

(e) Market Risk

The Gallery is exposed to foreign currency exchange risk only to the extent that some

contracts, mainly exhibition contracts and art acquisition contracts, are in foreign currency.

As far as possible, the Gallery minimises this risk by negotiating contracts in Australian

dollars and by keeping payment terms short. Where this is not possible and the amount is

material, the Gallery may offset foreign currency exchange risks by holding foreign

currency when approved by the Treasurer under the

Statutory Bodies Financial

Arrangements Act

1982. The Gallery is not currently holding foreign exchange reserves for

this purpose.

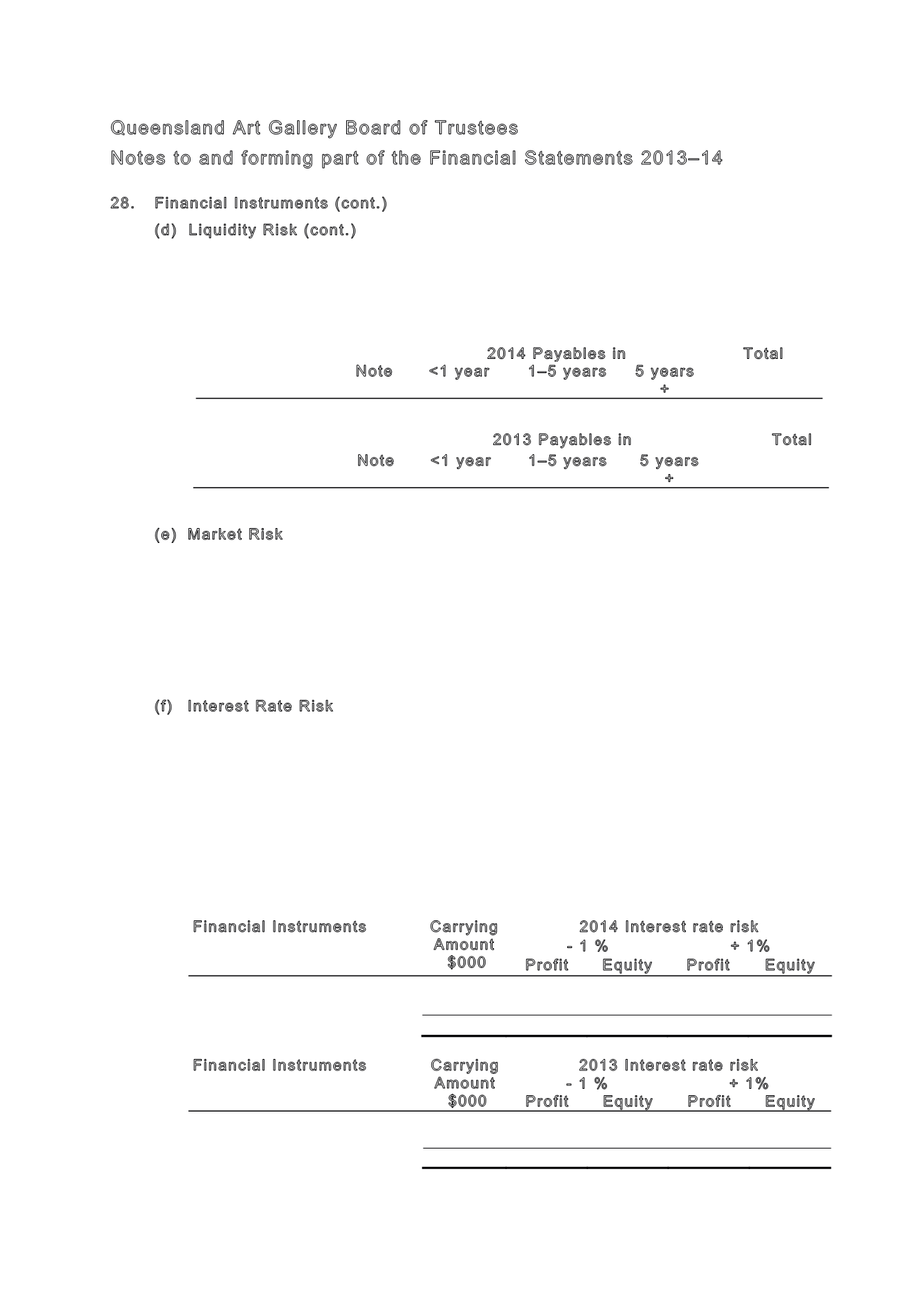

(f) Interest Rate Risk

The Gallery is exposed to interest rate risk through cash deposited in interest-bearing

accounts. The Gallery does not undertake any hedging in relation to interest risk. Interest

returns on investments are managed in accordance with the Gallery’s investment policies.

The following interest rate sensitivity analysis is based on a report similar to that which

would be provided to management, depicting the outcome to profit and loss if interest

rates changed by +/-1% from the year-end rates applicable to the Gallery’s financial

assets and liabilities. With all other variables held constant, the Gallery would have a

reserves and equity increase/(decrease) of $315,000 (2013: $237,000). This is

attributable to the Gallery's exposure to variable interest rates on interest-bearing cash

deposits.

Financial Instruments

Carrying

Amount

$000

2014 Interest rate risk

- 1 %

+ 1%

Profit

Equity

Profit

Equity

Cash and Cash Equivalents

9,506

(95)

(95)

95

95

Other Financial Assets

21,968

(220)

(220)

220

220

Overall effect on profit and loss

31,474

(315)

(315)

315

315

Financial Instruments

Carrying

Amount

$000

2013 Interest rate risk

- 1 %

+ 1%

Profit

Equity

Profit

Equity

Cash and Cash Equivalents

3,240

(32)

(32)

32

32

Other Financial Assets

20,476

(205)

(205)

205

205

Overall effect on profit and loss

23,716

(237)

(237)

237

237

2014 Payables in

Total

Note

<1 year

1–5 years

5 years

+

Payables

17

2,150

-

-

2,150

2013 Payables in

Total

Note

<1 year

1–5 years

5 years

+

Payables

17

1,585

-

-

1,585