Queensland Art Gallery Board of Trustees Annual Report 2013–14

FINANCIAL STATEMENTS

PART B

30

30

Queensland Ar t Gallery Board of Trustees

Notes to and forming par t of the Financial Statements 2013–14

27. Contingent Liabilities

(a) Litigation in progress

The Gallery does not have any litigation before the Courts, nor is it aware of any pending

litigation.

(b) Financial Guarantees

As part of contractual negotiations (mainly in relation to exhibition or sponsorship

contracts), the Gallery is occasionally required to provide financial guarantees. In

accordance with the

Statutory Bodies Financial Arrangements Act 1982

, the Gallery has

approval from the Treasurer to provide financial guarantees under certain conditions; the

balance of the guarantees are approved by the Treasurer. The guarantees are not

recognised in the Statement of Financial Position as the Gallery does not expect the

guarantees to be called upon. As at 30 June 2014, there were no material guarantees in

place.

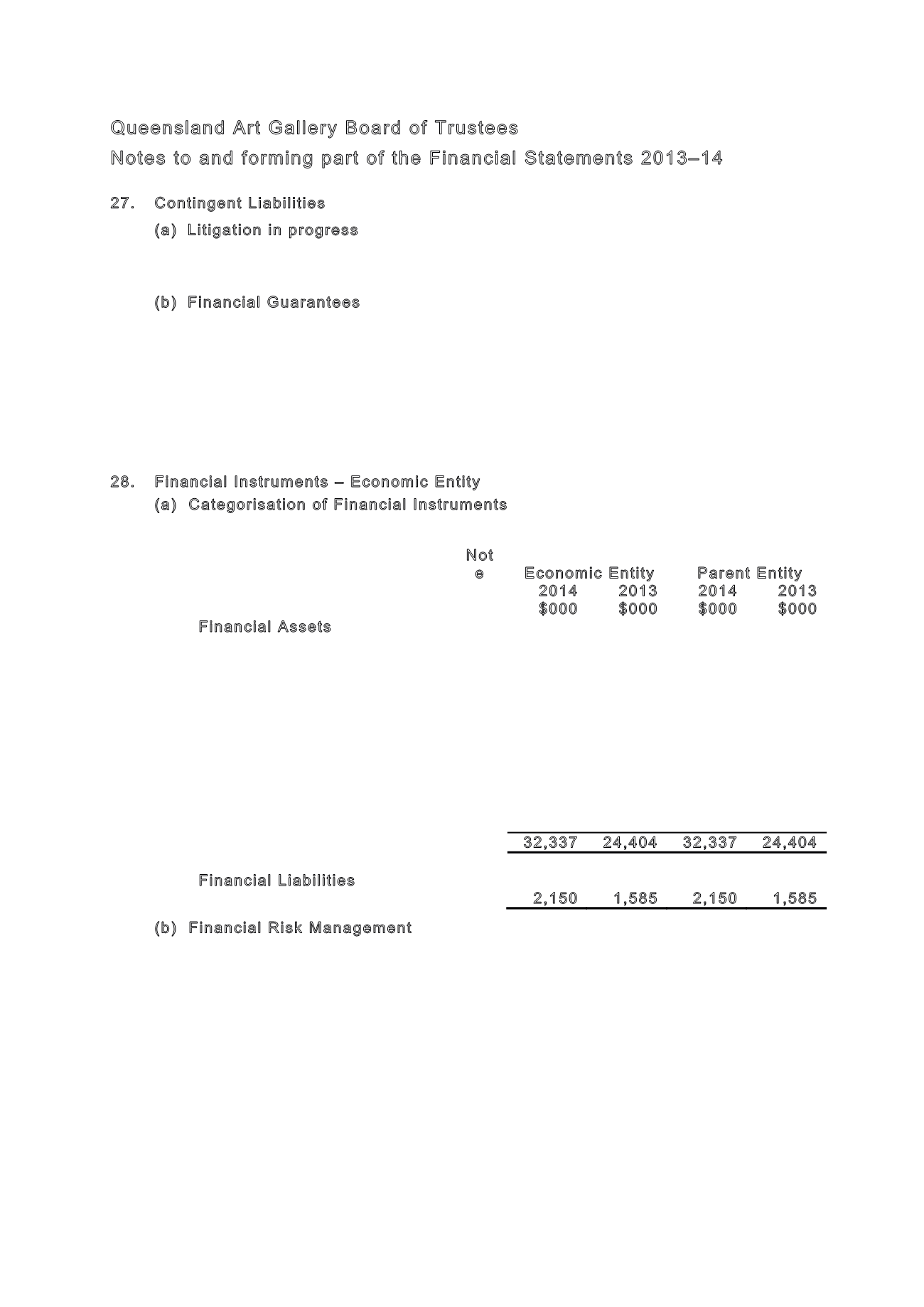

28. Financial Instruments – Economic Entity

(a) Categorisation of Financial Instruments

The Gallery has the following categories of financial assets and financial liabilities:

Not

e

Economic Entity

Parent Entity

2014

2013

2014

2013

$000

$000

$000

$000

Financial Assets

Cash and cash equivalents

12

9,506

3,240

9,506

3,240

Receivables

13

863

688

863

688

Held-to-maturity investments:

Term deposits with financial

institutions – held at amortised

cost

14

7,000

8,000

7,000

8,000

Investments held at fair value:

Investments in the QTC Capital

Guaranteed Cash Fund

14

976

902

976

902

Investments in the QIC Growth

Fund

14

13,992

11,574

13,992

11,574

Total

32,337 24,404 32,337 24,404

Financial Liabilities

Payables

17

2,150

1,585

2,150

1,585

(b) Financial Risk Management

The Gallery’s activities expose it to a variety of financial risks — interest rate risk, credit

risk, liquidity risk and market risk.

Financial risk management is implemented pursuant to government and Gallery policies.

These policies focus on the unpredictability of financial markets and seek to minimise

potential adverse effects on the financial performance of the Gallery. Financial risk is

managed by the Financial Services Section, in accordance with these policies.

The Financial Services Section regularly reports to the Queensland Art Gallery Board of

Trustees and the Queensland Art Gallery | Gallery of Modern Art Foundation Committee in

relation to financial assets.

The Gallery measures risk exposure using a variety of methods as follows: